Closure of the Feed-in Tariff Scheme

The Government has closed the feed-in tariff scheme for new applicants as of the 1st April 2019, so new installations will no longer be eligible for support from this point onwards. Over the past 8 years, the scheme has been incredibly successful, and resulted in PV on over 750,000 homes. However, as we show below, solar PV is now so cheap, that such policy support it no longer needed, and solar PV remains the cheapest way to supply electricity to a building, even without subsidy.

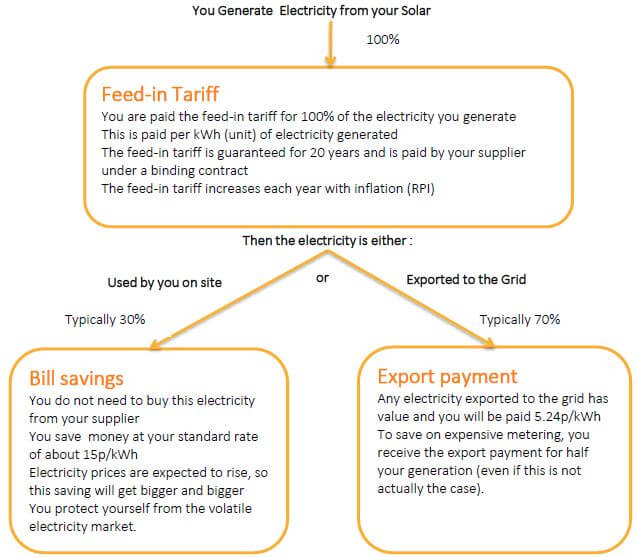

For customers who installed before April 2019, your syetm remains eligible for feed-in tariff payments and you will continue to be paid these by your utility until the end of their 20 year term.